-

Undergraduate Students

Eligibility:

Stafford student loans have a variable interest rate that is set on July 1st of each year. Repayment begins 6 months after the student exits school or drops below 1/2 time enrollment. Students must be enrolled for at least 6 credit hours per semester to apply for Stafford loans. The Fall Semester includes classes from August to December. The Spring Semester includes classes from January to May. The Summer term includes classes from May to August. We recommend that students pre-register for all Fall classes prior to the beginning of the Fall Semester and all Spring classes prior to the beginning of the Spring Semester to avoid processing delays.Disbursement:

Student loan funds are disbursed in two payments. If your loan is for the academic year (Fall and Spring), you will receive one disbursement at the beginning of each semester. The disbursements are sent to the school to be applied to your student account. Peru State College will refund any excess funds to you in the form of a "refund check."Application Process:

For each academic year for which you will need financial aid, you must complete a FAFSA at www.studentaid.gov. You and your parent(s) (if applicable) will need a Federal Student Aid (FSA) ID to complete and electronically sign your FAFSA. Students and parents must each have their own FSA ID’s. To apply for an FSA ID, visit https://www.studentaid.gov. Your FSA ID is also used to log into federal sites such as the National Student Loan Data System (NSLDS) at www.nslds.ed.gov, www.studentloans.gov, and www.StudentAid.gov.Peru State College’s FAFSA school code is 002559. Be sure to list Peru State College’s code when completing your FAFSA.

Additional Requirements:

If you have previously attended Peru State College, you must be in compliance with the Satisfactory Academic Progress Requirements to be eligible for financial aid (even if you did not receive aid during your prior period of attendance).In some cases, the college is required to verify the information you reported on the FAFSA. If your application is selected for verification, the Financial Aid Office will send you a notification requesting verification worksheets and copies of your IRS return transcripts.

If you are in default on a prior student loan, you are not eligible for additional student loans.

If you have already borrowed the aggregate maximum ($31,000 for a dependent student and $57,500 for an independent student), you are not eligible for additional student loans.

-

Graduate Students

Eligibility: Graduate students are not eligible for grants; however, they can apply for Direct student loans. Direct loans have a variable interest rate that is set on July 1st of each year. Repayment begins 6 months after the student exits school or drops below ½ time enrollment. Students must be enrolled for at least 6 credit hours per semester to apply for Direct loans. The Fall Semester includes classes from August to December. The Spring Semester includes classes from January to May. The Summer term includes classes from May to August. We recommend that students pre-register for all Fall classes prior to the beginning of the Fall Semester and all Spring classes prior to the beginning of the Spring Semester to avoid processing delays. Disbursement: Student loan funds are disbursed in two payments. If your loan is for the academic year (Fall and Spring), you will receive one disbursement at the beginning of each semester. The disbursements are sent to the school to be applied to your student account. Peru State will refund any excess funds to you in the form of a “refund check.” Application Process:

- To be eligible to receive financial aid, you must complete the admissions process and be fully admitted to the graduate program at Peru State College.

- You will need a Federal Student Aid (FSA) ID to complete and electronically sign your FAFSA. Your FSA ID is used to log in to FAFSA on the Web www.studentaid.gov, the National Student Loan Data System (NSLDS) www.nslds.ed.gov, www.studentloans.gov and www.studentaid.gov. To create your FSA ID, visit https://www.studentaid.gov.

- Complete a “Free Application for Federal Student Aid” (FAFSA form). This form can be completed on-line at www.studentaid.gov.

- Complete the loan application process. All new borrowers must complete both steps.

- Loan Entrance Counseling: Go here and click on Direct Loan Entrance Counseling to begin.

- Master Promissory Note

Other Eligibility Requirements:

- If you have previously attended Peru State College, you must be in compliance with the Satisfactory Academic Progress requirements to be eligible for financial aid (even if you did not receive aid during your prior period of attendance).

- In some cases, the college is required to verify the information reported by the student on the FAFSA form. If your application is selected for verification, the Financial Aid Office will send you a notification requesting verification worksheets and copies of your income tax forms.

- If you are in default on a prior student loan, you are not eligible for additional student loans.

- If you have already borrowed the aggregate maximum ($138,500), you are not eligible for additional student loans.

-

Code of Conduct

Peru State College financial aid professionals help students pursue their educational goals and achieve success by providing information about and access to appropriate financial resources. To this end, financial aid staff members are guided by a set of principles that serve as a common foundation for an acceptable standard of conduct.

- No action will be taken by financial aid staff that is for their personal benefit or could be perceived to be a conflict of interest.

- Employees within the financial aid office will not award aid to themselves or their immediate family members. Staff will reserve this task to an institutionally designated person, to avoid the appearance of a conflict of interest.

- The college has no preferred lending agreement with any lender of private educational loans and does not maintain a preferred lender list. Neither the college nor any employee shall enter into any revenue-sharing arrangement with any lender or accept offers of funds for private loans to students in exchange for providing concessions or promises to the lender for a specific number of loans, a specified loan volume, or a preferred lender arrangement.

- A borrower’s choice of a lender will not be denied, impeded, or unnecessarily delayed by the institution. Borrowers will not be auto-assigned to any particular lender.

- No amount of cash, gift, or benefit in excess of a de minimis amount shall be accepted by a financial aid staff member from any financial aid applicant (or his/her family), or from any entity doing business with or seeking to do business with the institution (including service on advisory committees or boards beyond reimbursement for reasonable expenses directly associated with such service).

- No compensation may be accepted for any type of consulting arrangement or contract to provide services to or on behalf of a lender relating to education loans.

- Information provided by the financial aid office is accurate, unbiased, and does not reflect preference arising from actual or potential personal gain.

- Institutional award notifications and/or other institutionally provided materials shall include the following:

- A breakdown of individual components of the institution’s Cost of Attendance.

- Clear identification of each award, indicating type of aid, i.e. gift aid (grant, scholarship), work, or loan.

- Standard terminology and definitions.

- Renewal requirements for each award.

- All required consumer information is displayed in a prominent location on the institutional web site(s) and in any printed materials, easily identified and found, and labeled as “Consumer Information.”

- Financial aid professionals will disclose to their institution any involvement, interest in, or potential conflict of interest with any entity with which the institution has a business relationship.

Statement of Ethical Principles The primary goal of the institutional financial aid professional is to help students achieve their educational goals by providing appropriate financial support and resources. To this end, this statement provides that the financial aid professional shall: Advocate for students

- Remain aware of issues affecting students and continually advocate for their interests at the institutional, state and federal levels.

- Support federal, state and institutional efforts to encourage students to aspire to and plan for education beyond high school.

Manifest the highest level of integrity

- Commit to the highest level of ethical behavior and refrain from conflict of interest or the perception thereof.

- Deal with others honestly and fairly, abiding by our commitments and always acting in a manner that merits the trust and confidence others have placed in us.

- Protect the privacy of individual student financial records.

- Promote the free expression of ideas and opinions, and foster respect for diverse viewpoints within the profession.

Support student access and success

- Commit to removing financial barriers for those who want to pursue postsecondary learning and support each student admitted to our institution.

- Without charge, assist students in applying for financial aid funds.

- Provide services and apply principles that do not discriminate on the basis of race, gender, ethnicity, sexual orientation, religion, disability, age, or economic status.

- Understand the need for financial education and commit to educate students and families on how to responsibly manage expenses and debt.

Comply with federal and state laws

- Adhere to all applicable laws and regulations governing federal, state, and institutional financial aid programs.

- Actively participate in ongoing professional development and continuing education programs to ensure ample understanding of statutes, regulations, and best practices governing the financial aid programs.

- Encourage colleagues to participate in the financial aid professional associations available to them at the state, regional, or national level and offer assistance to other aid professionals as needed.

Strive for transparency and clarity

- Provide our students and parents with the information they need to make good decisions about attending and paying for college.

- Educate students and families through quality information that is consumer-tested when possible. This includes (but is not limited to) transparency and full disclosure on award notices.

- Ensure equity by applying all need-analysis formulas consistently across the institution’s full population of student financial aid applicants.

- Inform institutions, students, and parents of any changes in financial aid programs that could affect their student aid eligibility.

Protect the privacy of financial aid applicants

- Ensure that student and parent private information provided to the financial aid office by financial aid applicants is protected in accordance with all state and federal statutes and regulations, including FERPA and the Higher Education Act, Section 483(a)(3)(E) (20 U.S.C. 1090).

- Protect the information on the FAFSA from inappropriate use by ensuring that this information is only used for the application, award, and administration of aid awarded under Title IV of the Higher Education Act, state aid, or aid awarded by eligible institutions.

**This was adopted in part from the National Association of Student Financial Aid Administrators’ Statement of Ethical Principles and Code of Conduct for Financial Aid Professionals. The obligations in this Code of Conduct are in addition to any requirements imposed by state or federal laws, or Peru State College policies.

- No action will be taken by financial aid staff that is for their personal benefit or could be perceived to be a conflict of interest.

-

Consortium Agreement

What is a Consortium Agreement? A consortium agreement is a written agreement between two schools. This agreement allows a student to be co-enrolled at Peru State and another institution and receive Federal financial aid based on the combined enrollment at both institutions. The home institution (Peru State College) is the institution from which the student is seeking a degree. Typically, the student receives financial aid from the degree-granting institution (the home institution). Students must be enrolled in at least 6 credits at Peru State in order to utilize a consortium agreement. The host institution is the institution where the student will be visiting and taking classes to transfer back to the home institution. The courses taken at the host institution must be applicable toward the student’s degree at Peru State College. Consortium Agreement courses will be counted towards the term in which they start.

What are the steps in completing a Consortium Agreement? Step 1: Complete Section A of the Peru State College Consortium Agreement . Consortium Agreement Fall 2023 Consortium Agreement Spring 2024 Step 2: Take the Consortium Agreement to the Academic Division Dean in your field of study to complete Section B. The Academic Division Dean will forward the Consortium Agreement to the Registrar at Peru State College. Step 3: The Registrar at Peru State College will forward the Consortium Agreement to the host institution’s Financial Aid Office. When they have completed their section, they will return the Consortium Agreement to Peru State’s Financial Aid Office. Step 4: The College's Financial Aid Office will complete Section D of the Consortium Agreement and process your financial aid accordingly. Step 5: When you have completed your courses at the host institution, it is your responsibility to submit a copy of your final grade to the Peru State College Financial Aid Office. Grades at both the home and host institution will be reviewed to determine if you are in compliance with the Satisfactory Academic Progress requirements at Peru State. Future aid will be on hold until all grades have been submitted and your status can be determined. -

Drug Conviction Disclosure

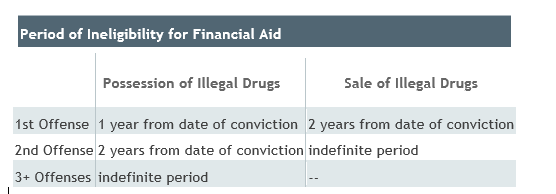

Federal regulations require that we provide this information to all students who enroll at Peru State College. Although penalties are only imposed when students are receiving Federal Title IV student financial aid, including student loans, we notify all students. Please take a moment to read and understand this information. You may direct any questions to the Office of Financial Aid. Students Convicted of Possession or Sale of Drugs A federal or state drug conviction can disqualify a student from receiving financial aid. Convictions only count if they were for an offense that occurred during a period of enrollment for which the student was receiving Title IV aid (financial aid). This means the conviction only has consequences for financial aid if you were also enrolled in school at the same time. Also, a conviction that was reversed, set aside or removed from the student’s record does not count, nor does one received when they were a juvenile, unless they were tried as an adult. The chart below illustrates the period of ineligibility for financial aid, depending on whether the conviction was for sale or possession and whether the student had previous offenses. A conviction for sale of drugs includes convictions for conspiring to sell drugs.

If the student was convicted of both possessing and selling illegal drugs, and the periods of ineligibility are different, the student will be ineligible for the longer period. Notice After Loss of Eligibility If a student is convicted of possession or sale, the student is no longer eligible for Title IV financial aid. How to Regain Eligibility The information that follows describes the methods by which students may regain eligibility. A student regains eligibility the day after the period of ineligibility ends or when they successfully complete a qualified drug rehabilitation program. Further drug convictions will make them ineligible again. Students denied eligibility for an indefinite period can regain it only after successfully completing a rehabilitation program or if a conviction is reversed, set aside or removed from the student’s record so that fewer than two convictions for sale or three convictions for possession remain on the record. In such cases, the nature and dates of the remaining convictions will determine when the student regains eligibility. It is the student’s responsibility to certify they have successfully completed the rehabilitation program. For any questions please contact the One Stop office at 402-872-2228 Monday through Friday from 8:00 a.m. to 5:00 p.m. or by email at onestop@peru.edu.

-

Federal Title IV Funds Refund Policy and Procedures

If you completely withdraw from Peru State College and you are a financial aid recipient, a portion of your financial aid may be returned to the Department of Education. This is part of the USDE guidelines for the Return of Title IV Funds requirements. For more information on the Return of Title IV refund policies, please contact the One Stop Office. Refunds of tuition, fees, on-campus room and board charges will be calculated based on the number of days remaining in the semester at the time of the withdrawal. Financial aid refunds received for other educational expenses will be calculated based on the number of days remaining in the term at the time of the withdrawal. Refunded amounts are considered unearned financial aid and must be returned to the appropriate financial aid programs. Students are responsible for returning the amount owed. Failure to repay the amount owed will result in future financial aid ineligibility and possibly having your account turned over to the United States Department of Education. The refunded amounts will be returned in the following order:

- Unsubsidized Direct Loan

- Subsidized Direct Loan

- Direct PLUS loan

- Federal Pell Grant

- Federal SEOG

- Other Federal Financial Aid as applicable

-

Satisfactory Academic Progress (SAP)

Federal financial aid regulations require Peru State College to establish and enforce standards of Satisfactory Academic Progress (SAP). SAP is checked the first time a student applies for financial aid and prior to aid disbursement each term.

When SAP is checked for a student, all prior semesters of attendance are considered, even if the student did not receive financial aid for prior semesters.

Requirements

There are 3 requirements for Satisfactory Academic Progress:1. Cumulative Grade Point Average (Cumulative GPA)

Undergraduate students 2.00

Graduate students 3.00

Cumulative GPA can be estimated using our online GPA calculator.

2. Cumulative Credit Completion Rate (Cumulative Pace)

Cumulative pace is measured by dividing the cumulative number of completed credits by the cumulative number of attempted credits. Students must maintain a minimum cumulative pace of 67%. For financial aid purposes, a course is considered completed if a grade of A, B+, B, C+, C, D+, D, or CR is earned. Grades of F, NR, I, and W are considered attempted but not completed.

3. Maximum Attempted Credits Limit

The maximum time frame for completing a degree is limited by federal regulations to 150% of the published number of credit hours required to complete the degree program.

Undergraduate degree attempted credits limit: 180 attempted credits

Graduate degree attempted credits limit: 54 attempted credits

Completed credits, transfer credits, College Level Examination Program (CLEP) credits, dual enrollment credits, and courses with grades of F, NR, I, and W all count toward the maximum attempted credits limit.

The maximum attempted credits limit for students pursuing teacher certification or re-certification will be determined on an individual basis.

Treatment of the Following Types of Courses for SAP

Repeated Courses: Repeated courses count as attempted credits and, when passing grades are received, they also count as completed credits.College Level Examination Program (CLEP): CLEP courses count as both attempted and completed credits.

Transfer Courses: Credits transferred to Peru State College from another institution count as both attempted and completed credits.

Dual Credit Courses: Dual credit courses count as attempted credits and, when passing grades are received, they also count as completed credits.

SAP Statuses

Meets SAP

The Meets SAP status is assigned to students in two circumstances: 1) it is the student’s first semester at Peru State, and 2) when, after their most recent semester, they meet all 3 standards of Satisfactory Academic Progress.

Warning

Students are placed on Warning status when, after their most recent semester of attendance, they are deficient in either their cumulative GPA, their cumulative Pace, or both. Students on Warning status are eligible to receive financial aid.

Suspension

Suspension status is assigned to students in three circumstances: 1) the student was on Warning status and at the end of their warning semester, they do not meet the standards for cumulative GPA, cumulative Pace, or both, 2) the student has reached the maximum attempted credits limit, and 3) the student has not yet reached the maximum attempted credits limit, but it is not possible for the student to complete their program prior to reaching the maximum attempted credits limit.

There are two ways students with Suspension status can earn reinstatement: 1) secure approval of an appeal (details below) or 2) pay on their own for one or more semesters until they meet all three satisfactory progress requirements, then notify the Financial Aid Office.

Probation

When a Satisfactory Academic Progress appeal is approved for a suspended student, the student is placed in Probation status and will be eligible to receive aid during the probationary semester(s). Students on probation are placed on a monitoring plan and are required to achieve a minimum semester GPA of 2.00 undergraduate/3.00 graduate and complete a minimum of 100% of all attempted credits for the semester. Students who meet the probation requirements, but still do not meet all of the Satisfactory Academic Progress requirements, may have their probation extended to their next term of enrollment. There is not a limit on the number of consecutive terms a student can be on Probation status.

Appeal Process

Students placed in Suspension status due to their cumulative GPA, their cumulative course completion rate, or both, or maximum attempted credits limit have the right to submit an appeal based on mitigating circumstances (unusual or extraordinary circumstances beyond their control that the student could not have planned for). Submission of an appeal is not a guarantee of approval.

Appeals must include the following:

- A written statement explaining: 1) the mitigating circumstance(s) that prevented the student from meeting SAP requirements, and 2) what has changed in the student’s situation that will allow for a higher cumulative GPA, a higher course completion rate, or both by the end of the next SAP evaluation period.

- Third-party documentation that supports the information in the student’s written statement (e.g., medical documents, obituary notices, legal documents, police reports). Statements from friends and family cannot be considered.

- A personal statement explaining why you have accumulated and/or attempted excess units for your degree. If you have taken or plan to take courses that are not required, give your reasons for taking them. Indicate if you have changed your major or program, and if so, why.

Examples of mitigating circumstances include, but are not limited to:

Serious injury or illness of the student, spouse, or child; death of a family member.

Examples of circumstances that are NOT mitigating include, but are not limited to:

Problems accessing required books and supplies, personality conflicts with instructor, transportation problems, loss of child’s day care provider.

Repeat Coursework

Federal regulations stipulate that federal aid may only be awarded to an undergraduate student once for a previously passed course (one repetition per class). The Financial Aid Office is required to monitor students' repeat coursework to determine financial aid eligibility. Students are not eligible to receive federal or state aid for a previously passed course repeated more than one time.

Repeat Policy Conditions

- If a student passes a course once and repeats the course for a better grade, the student may not be paid for taking the course a 3rd time, even if the desired grade was not earned in the 2nd attempt.

- If a student passes a course once and then repeats the course and fails the 2nd attempt, that failure counts as their final attempt and the student may be not paid for taking the course a 3rd time.

- For Satisfactory Academic Progress (SAP), each time a course is taken will count as an attempt when measuring progress toward a degree.

- A student may be repeatedly paid for repeatedly failing the same course.

Important Notice

Financial Aid Warning, Probation, and Suspension are completely different than Academic Contract, Probation, and Suspension. Appeals submitted for financial aid Satisfactory Academic Progress do not affect Academic Contract, Probation and Suspension, which has a separate appeal process. Approval of an Academic appeal does not guarantee approval of a Financial Aid appeal.

Financial Avenue

Peru State College has teamed up with Inceptia to provide financial education via their online program, Financial Avenue. With Financial Avenue, you receive smart resources to help demystify the world of personal finance. Getting a handle on your money doesn’t have to feel overwhelming or restrictive. It’s all about empowering yourself with smart basics, and planning from there. With Inceptia, you will have access to ten online courses that take on big financial topics, including:

- Psychology of Money

- Foundations of Money

- College and Money

- FAFSA

- Loan Guidance

- Earning Money

- Credit and Protecting Your Money

- Spending and Borrowing

- Debt and Repayment

- Future of Your Money

Getting Started Get started by setting up your private account at FinancialAvenue.org. Once there, just click the “Login” link at the top of the page, click to sign up as a student and then provide your access code shown below. To create your account, you’ll need your school specific email address and a password of your choosing. ACCESS CODE: bobcat$ -- Current Students bobcatcents -- Prospective Students and parents Returning Users Using your email address and password, you can return to your Financial Avenue account any time to review or finish courses, access tools and tips, and track your progress.

Questions or Support Issues Inceptia Customer Service 888-454-4668 customerservice@financialavenue.org

Financial Aid Programs

Eligibility for financial aid is based on the results of the Free Application for Federal Student Aid (FAFSA) form.

-

Grants

Grants, unlike loans, do not have to be repaid. Grants are awarded to undergraduate students with exceptional financial need. Students who have already earned a bachelor’s degree are not eligible for grants, with the exception of the TEACH grant. Grant eligibility is based on family income, family size, assets, and other information submitted on the FAFSA form.

- Federal Pell Grant- The Federal Pell Grant is need-based. It is awarded to eligible undergraduates, who have an Expected Family Contribution (EFC) up to $6,656 as calculated by the 2023/2024 FAFSA. The estimated maximum Pell Grant for 2023/2024 is $7,395.

- Federal Supplemental Educational Opportunity Grant (FSEOG) -This is a federally funded program for undergraduate students with exceptional need. Students must be Pell grant eligible. Funds are very limited.

- Nebraska Opportunity Grant (NOG) - This is a state grant and students must be a Nebraska resident, attending a Nebraska postsecondary institution, and meet the EFC requirement.

- Teacher Education Assistance for College and Higher Education Grant (TEACH) – This is a federal grant available to Undergraduate and Graduate students, completing their degree in education. Students must be enrolled in eligible programs and have earned a cumulative GPA of at least 3.25, or score above the 75th percentile on one or more portions of a college admissions test. Students must complete the TEACH Grant initial and subsequent counseling, and sign an Agreement to Service (ATS).

-

Loans

Federal Direct Loan Programs- Several loan programs are available to assist students with the cost of their education. Visit www.studentaid.gov to find the U.S Department of Education’s information on your federal loan history, enrollment and repayment status, lenders and loan servicer(s). The following loan programs are available:

- Undergraduate subsidized loan - Awarded on the basis of financial need. Interest on subsidized loans is paid by the federal government while a student is enrolled at least half-time. Repayment begins six months after graduation or when your enrollment drops below half-time.

- Undergraduate unsubsidized loan - Is not awarded on the basis of financial need. Students accrue interest from the time the loan is disbursed until it is paid in full. Students may opt to allow the interest to accumulate while you are in school. The interest will be added to the principal of the loan. Repayment begins six months after graduation or when your enrollment drops below half-time.

- Graduate unsubsidized loan - Is not awarded on the basis of financial need. Students accrue interest from the time the loan is disbursed until it is paid in full. Students may opt to allow the interest to accumulate while you are in school. The interest will be added to the principal of the loan. Repayment begins six months after graduation or when your enrollment drops below half-time.

First Time Student Loan Borrowers must complete Entrance Counseling and sign a Master Promissory Note for Federal Direct Loans All Federal Loans (subsidized, unsubsidized, and Parent PLUS) must be accepted by the student and originated with the Department of Education before the end of the term of enrollment.

Federal Direct Loan Eligibility

The annual maximums are as follows:

Dependent Students

- Freshman - $5,500

- Sophomore - $6,500

- Junior/Senior 2nd BA - $7,500

- Post Graduate Undergrad

- Teacher Certificate - $7,500

- Graduate - $20,500

Independent Students

- Freshman - $9,500

- Sophomore - $10,500

- Junior/Senior 2nd BA - $12,500

- Post Graduate Undergrad/Graduate Teacher Certificate - $12,500

- Graduate - $20,500

Federal PLUS Loan (for parents) – interest rate

Parents of undergraduates can apply for a federal loan in the parent’s name to help fund educational costs. PLUS loans are credit based and a credit check will be performed by the U.S. Department of Education. Repayment begins immediately after it is fully disbursed. You may request a deferment while your student is enrolled at least half-time and for an additional six months after your student graduates, leaves school, or drops below half-time status. Federal PLUS Loan Borrowers must complete: Parent PLUS Loan Application and sign a Master Promissory Note

-

Alternative/Private Educational Loans

Alternative private loans are offered through a lending institution and are not a part of federal student aid programs. Interest rates and fees for private loans vary between lenders and are typically based on the credit of the borrower and cosigner. It is the responsibility of the student to research and understand the implications of borrowing an alternative educational loan. Keep in mind that alternative loans, along with other aid and educational resources, can never be more than the cost of attendance. We strongly encourage students to file a Free Application for Federal Student Aid (FAFSA) to determine their eligibility for federal student aid and Federal Direct Loans before considering alternatives. While there is a great range of private educational loans available, we do not recommend alternative loans in most cases, as they do not have the beneficial aspects of Federal Direct Loan programs. If you need to pursue a private loan, make sure you research lenders and get all the facts. To compare alternative loan lenders, Peru State uses ELM Select . This allows students to compare various alternative loans. These are the most used lenders by our students and this is not a preferred lender list. Students are encouraged to compare these loans with one another, as well as with alternative student loan products offered by other lenders. Students have the right to use a lender that is not listed at ELM Select .

-

Work-Study

The Federal Work-Study Program is a need-based financial aid program that provides part-time employment for students. The program helps students meet their educational expenses by working rather than incurring a heavy burden of student loan debt. In addition, the program can provide valuable work experience. Please visit Student Employment | Federal Work Study for available work-study positions.

-

Scholarships

Peru State College offers a wide range of scholarships. Awards are based on academic achievement, financial need, leadership and special abilities (athletics, art, music). Please visit the Scholarships Page for Peru State College scholarships. There are several external scholarship sites we recommend students to pursue. To avoid being a victim of a scholarship scam, students and their families should keep in mind the following tips: *Typically scholarship applications do not require your social security number. *If you must pay money to get some money, it might be a scam. *If it sounds too good to be true, it probably is. *Never invest more than a postage stamp to get information about a scholarship. *No one can guarantee that you’ll win a scholarship. *Legitimate scholarship foundations do not charge application fees. Please visit these free personalized scholarship search sites:

-

Returning Student Scholarships

Peru State College offers a variety of scholarships. The Admissions Office awards New Student & Transfer Student Scholarships. The Financial Aid Office awards Returning Student Scholarships and Need-based Scholarships. Returning students need to complete a Scholarship Application each year to be considered. The priority deadline is posted annually. Scholarship applications received after the deadline will only be considered for declined scholarships that become available for re-awarding. Students who want to be considered for need-based scholarships must also complete a FAFSA form by March 15th, annually. In addition to Peru State scholarships, there are numerous scholarships available through outside sources. Below are links to several free scholarship searches.

- www.collegeboard.org Click on “for students.” Under the “pay for college” section, click on “scholarship search.”

- www.educationquest.org Click on “scholarship quest.”

- www.fastweb.com Click on “find scholarships now.”

- www. lcf.org Click on "Student Scholarships" under the "Impacting Community" section at the bottom of the page

Be careful; there are lots of scholarship scams out there! Beware of any scholarship that requires a fee, asks for a credit card number, or makes any guarantees. For more information on scholarship scams, go to www.ftc.gov/scholarshipscams .

-

Summer Financial Aid

Students who wish to apply for summer aid must complete a Summer Financial Aid Application. The Summer Financial Aid Application will be available as a link in your myPSC portal in late March 2024. Before you can complete the application, you must be registered for your summer courses and we must have received your FAFSA results. Summer 2024 financial aid eligibility will be based on the results of the 2023/24 FAFSA. If you have not already completed a 2023/24 FAFSA, you can complete this application at www.studentaid.gov. The deadline for filing a 2023/24 FAFSA form is June 30, 2024. Financial aid eligibility for the summer term will be based on your total enrollment for all sessions within the summer term (mid May to mid August). Students who were enrolled for fall and spring semesters and received aid may have limited or no remaining eligibility for the summer term. If you have loan eligibility remaining, you will be offered a loan for the summer session. You must be enrolled for at least 6 credit hours to be eligible to receive a summer loan.

CARES Act Quarterly Reports

Student Reports

- Peru State College CARES Act Student Grants 30 Day Report

- Peru State College CARES Act Student Grants 45 Day Report

- Peru State College CRRSAA Student Grant March 31, 2021 Quarterly Report

- Peru State College CRRSAA Student Grant June 30, 2021 Quarterly Report

- Peru State College CRRSAA Student Grant September 30, 2021 Quarterly Report

- Peru State College CRRSAA Student Grant December 31, 2021 Quarterly Report

- Peru State College CRRSAA Student Grant March 31, 2022 Quarterly Report

Institutional Reports

- Peru State College CARES Act Institutional Grant Final Report

- Peru State College CRRSAA Institutional Grant December 31, 2020 Quarterly Report

- Peru State College CRRSAA Institutional Grant March 31, 2021 Quarterly Report

- Peru State College CRRSAA Institutional Grant June 30, 2021 Quarterly Report

- Peru State College CRRSAA Institutional Grant September 30, 2021 Quarterly Report

- Peru State College CRRSAA Institutional Grant December 31, 2021 Quarterly Report

- Peru State College CRRSAA Institutional Grant March 31, 2022 Quarterly Report

- Peru State College Higher Education Emergency Relief (HEER) Fund 2020

- Peru State College CRRSAA Institutional Grant June 30, 2022 Quarterly Report

- Peru State College CRRSAA Institutional Grant September 30, 2022 Quarterly Report

- Peru State College CRRSAA Institutional Grant December 30, 2022 Quarterly Report

- Peru State College CRRSAA Institutional Grant March 31, 2023 Quarterly Report

- Peru State College CRRSAA Institutional Grant June 30, 2023 Quarterly Report

- Peru State College CRRSAA Institutional Grant September 30, 2023 Quarterly Report

- Peru State College CRRSAA Institutional Grant December 31, 2023 Quarterly Report

Financial Aid Staff

| First Name | Last Name | Title | Area | Location | Phone | |

|---|---|---|---|---|---|---|

| Lauren | Beath | Assistant Director - Financial Aid | ADM 204 | 402-872-2378 | lauren.beath@peru.edu | |

| Denise | Lickteig | Director - Financial Aid | ADM 205 | 402-872-2379 | dlickteig@peru.edu | |

| Jennifer | Sikora | Financial Aid Specialist | Financial Aid | ADM 204 | 402-872-2228 | onestop@peru.edu |